Although the U.S. economy is well into a healing from the depths of the COVID-19 crisis, there’s been lots of news along the method that might have damaged markets or caused a more continual correction. So far, that hasn’t occurred.

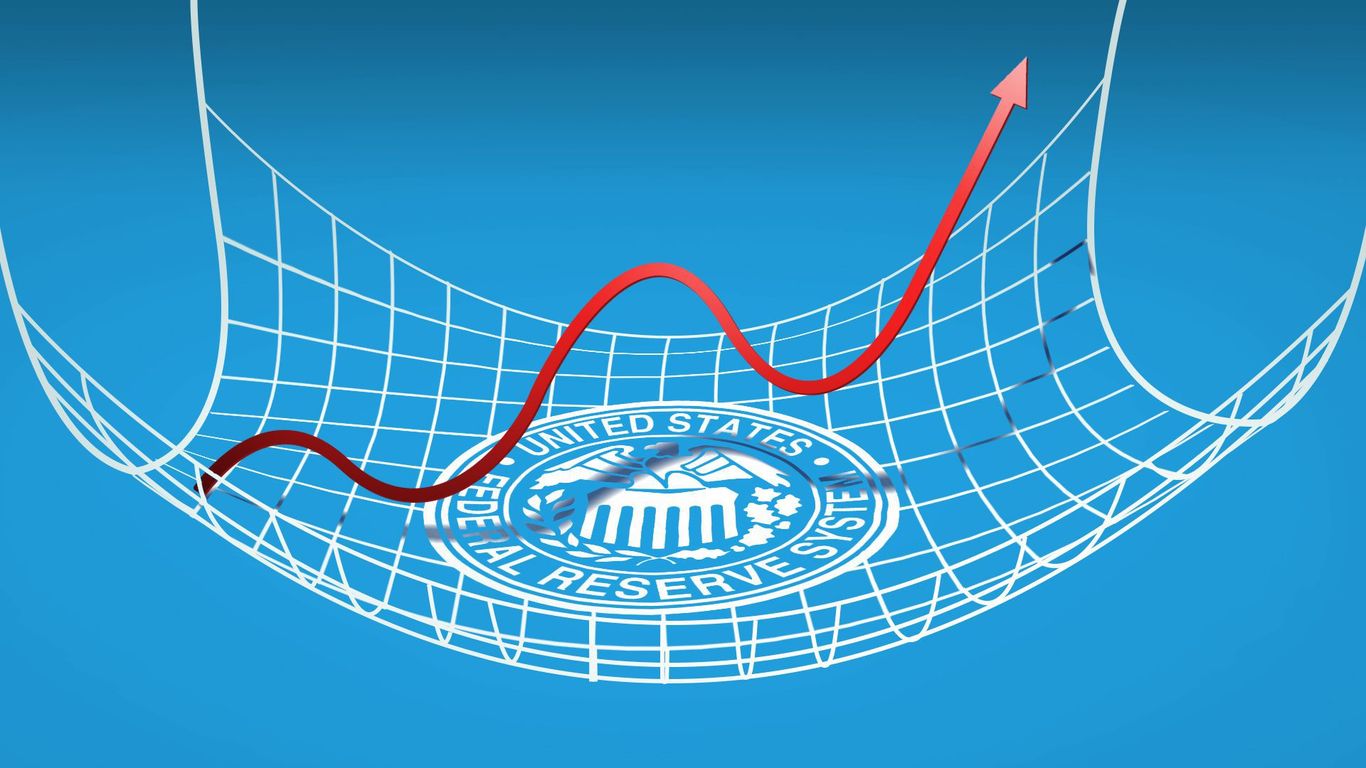

Why it matters: The equity market still has practically blind faith that the Federal Reserve will bail it out in a time of crisis, and, significantly in the belief that the present bout of inflation will be mainly short-term.

- ” Now we simply see flashes of worry, and after that it disappears. There’s so much peace of mind originating from the Fed,” Kristina Hooper, primary international market strategist at Invesco, informs Axios.

State of play: Wednesday’s market shocks from the huge expose that the Fed may raise rates earlier than anticipated– in 2023– have actually currently been rather taken in.

The huge image: In the last couple of months, the marketplace has actually shaken off frustrating tasks reports, remarkably high inflation development, and a hard-to-understand labor market imbalance

- The longest string of down days in the S&P 500 this year was one five-day duration, starting Feb. 16, according to S&P Global Market Intelligence. At the time, financiers were starting to rate in more powerful and much faster inflation.

- The S&P is up 14%for the year up until now.

Yes, however: Financial experts and experts continue to ignore a few of the threats to the healing, especially visible with the missed out on agreement in current tasks and inflation information, Hans Mikkelsen, credit strategist at BofA, informs Axios (h/t to a current BofA report by Mikkelsen, believing that worry is temporal, for the turn of expression).

- ” I believe we’re ignoring inflation. And I believe we are undervaluing how rapidly the Fed is going to alter its tone,” Mikkelsen stated in an interview on Wednesday– even prior to the Fed’s newest projections came out.

The bottom line: Though markets still have broad assistance from the Fed, look for volatility in the next couple of months considering that approximating the rate of the healing has actually shown tough, Mikkelsen states.

Go much deeper: The day whatever– and absolutely nothing– altered for the Fed

No comments:

Post a Comment